The smart Trick of What Does Ltv Mean In Mortgages That Nobody is Discussing

Forbearance is when your home loan servicer, that's the company that sends your home loan statement and handles your loan, or lender allows you to stop briefly or decrease your payments for a limited time period. Forbearance does not erase what you owe. You'll have to repay any missed or decreased payments in the future (what are the different types of home mortgages).

The types of forbearance offered differ by loan type. If you can't make your home loan payments because of the coronavirus, start by comprehending your choices and reaching out for aid. As you get ready for the possible spread of the coronavirus or COVID-19, here are resources to safeguard yourself financially. Federally-held trainee loan payments are held off and interest has actually been waived.

An adjustable rate mortgage is one in which for the first numerous years of the loan, the rate is fixed at a low rate. At the end of the fixed period, the rate changes when annually up or down based on an index included to a consistent margin number.

Assuming you make the typical payment on a monthly basis and not do anything differently, the majority of your home loan payment goes toward interest, instead of towards the balance, at the start of your loan. As you continue to make payments, this shifts in time. As you near the end of your loan term, most of your payment will approach the principal http://simonuogw005.tearosediner.net/excitement-about-how-do-points-work-in-mortgages rather than to interest.

The determination is based on its qualities along with current sales of similar homes in the area. The appraisal is essential due to the fact that the lending institution can not provide you an amount higher than what the home deserves. If the appraisal is available in lower than your offer amount, you can pay the distinction between the assessed worth and the purchase rate at the closing table.

When you're shopping for a mortgage, you're going to see two various rates. You'll see one rate highlighted and then another rate labeled APR (what are interest rates today on mortgages). The rate of interest is the expense for the lender to provide you the cash based upon existing market rates of interest. APR is the greater of the 2 rates and consists of the base rate as well as closing expenses connected with your loan, including any charges for points, the appraisal or pulling your credit.

How What Credit Score Do Banks Use For Mortgages can Save You Time, Stress, and Money.

When you compare interest rates, it is essential to take a look at the APR rather than simply the base rate to get a more complete picture of overall loan cost - what are interest rates now for mortgages. Closing on your house is the last step of the property procedure, where ownership is lawfully transferred from the seller to the buyer.

If you're buying a new residential or commercial property, you also get the deed. Closing day usually involves signing a lot of documents. Closing expenses, likewise known as settlement costs, are costs charged for services that need to be performed to process and close your loan application. These are the costs that were approximated Have a peek here in the loan price quote and consist of the title fees, appraisal fee, credit report cost, pest inspection, lawyer's costs, taxes and surveying charges, to name a few.

It's a five-page form that includes the final information of your mortgage terms and costs. It's a really important document, so be sure to read it thoroughly. Property comps (short for comparables) are homes that are similar to your home under factor to consider, with fairly the exact same size, location and amenities, and that have actually recently been offered.

Your debt-to-income ratio is the comparison of your gross regular monthly income (prior to taxes) to your regular monthly expenses revealing on your credit report (i. e., installation and revolving debts). The ratio is utilized to figure out how easily you'll have the ability to manage your new home. A deed is the real file you get when you close that states the home or piece of property is yours.

Earnest cash is a check you write when a seller accepts your offer and you draw up a purchase contract. Your deposit reveals good faith to the seller that you're major about the deal. If you eventually close on your house, this money goes towards your deposit and closing costs.

In the context of your home mortgage, most individuals have an escrow account so they do not have to pay the full cost of property taxes or homeowners insurance simultaneously. Rather, a year's worth of payments for both are spread out over 12 months and gathered with your monthly home mortgage payment.

The 6-Minute Rule for How Many Mortgages Can You Have At Once

The FICO rating was created by the Fair Isaac Corporation as a way for lending institutions and financial institutions to evaluate the creditworthiness of a debtor based upon an objective metric. Clients are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how recently they applied for new credit.

Credit score is among the main aspects in determining your home mortgage eligibility. A fixed-rate home loan is one in which the rate does not change. You always have the exact same payment for principal and interest. The only feature of your payment that would fluctuate would be taxes, property owners insurance coverage and association charges.

A house assessment is an optional (though extremely suggested) step in your purchase procedure. You can work with an inspector to go through the house and identify any prospective issues that may require to be addressed either now or in the future. If you find things that need to be repaired or repaired, you can negotiate with the seller to have them fix the issues or discount the sales rate of the home.

Additional expenses may apply, depending on your state, loan type and down payment quantity. Pay attention to the expenses listed in this file. Much of the expenses and costs can't change very much in between application and closing. For example, if the expenses of your real loan modification by more than a minimal amount, your loan estimate needs to be reprinted.

Make certain to ask your lending institution about anything you do not comprehend. The loan term is simply the quantity of time it would take to pay your loan off if you made the minimum principal and interest payment each month. You can get a fixed-rate conventional loan with a term of anywhere in between 8 thirty years.

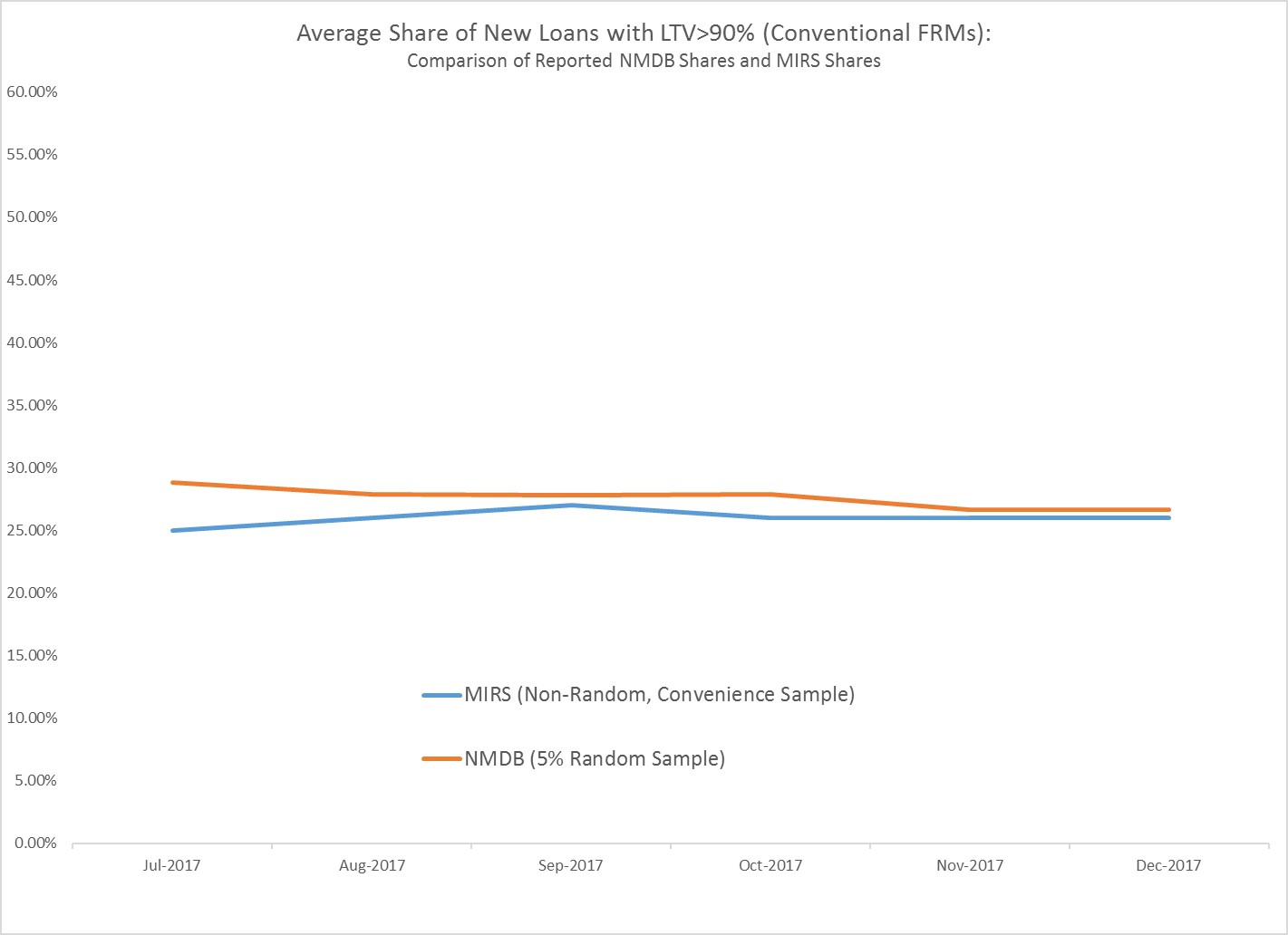

Adjustable rate home loans (ARMs) through Quicken Loans are based on 30-year terms. LTV is among the metrics your loan provider utilizes to determine whether you can get approved for a loan. All loan programs have a maximum LTV. It's computed as the amount you're obtaining divided by your home's worth. You can think about it as the inverse of your deposit or equity.

The 2-Minute Rule for What Do Underwriters Do For Mortgages

If you're purchasing a house, there's an intermediate action here where you will have to discover your home prior to you can formally complete your application and get financing terms. In that case, loan providers will provide Additional resources you a mortgage approval mentioning how much you can pay for based upon looking at your existing debt, income and properties.

It consists of details like the rates of interest and term of the loan as well as when payments are to be made. You might also see home mortgage points referred to as prepaid interest points or home mortgage discount points. Points are a method to prepay some interest upfront to get a lower rates of interest.

The smart Trick of What Are The Current Interest Rates For Mortgages That Nobody is Discussing

Forbearance is when your home mortgage servicer, that's the business that sends your home loan declaration and manages your loan, or lending institution enables you to stop briefly or reduce your payments for a minimal time period. Forbearance does not eliminate what you owe. You'll have to pay back any missed or decreased payments in the future (why do mortgage companies sell mortgages).

The kinds of forbearance readily available differ by loan type. If you can't make your mortgage payments due to the fact that of the coronavirus, start by understanding your alternatives and reaching out for help. As you get ready for the possible spread of the coronavirus or COVID-19, here are resources to protect yourself economically. Federally-held trainee loan payments are held off and interest has actually been waived.

An adjustable rate home mortgage is one in which for the very first numerous years of the loan, the rate is repaired at a low rate. At the end of the set period, the rate adjusts once per year up or down based on an index added to a constant margin number.

Assuming you make the typical payment monthly and do nothing differently, most of your home loan payment goes towards interest, rather than toward the balance, at the start of your loan. As you continue to pay, this shifts gradually. As you near completion of your loan term, most of your payment will approach the principal instead of to interest.

The decision is based on its qualities along with recent sales of comparable residential or commercial properties in the area. The appraisal is essential due to the fact that the loan provider can not lend you an amount greater than what the home deserves. If the appraisal is available in lower than your offer quantity, you can pay the difference in between the evaluated value and the purchase cost at the closing table.

When you're buying a home loan, you're going to see 2 different rates. You'll see one rate highlighted and after that another rate identified APR (what is a hud statement with mortgages). The rates of interest is the cost for the loan provider to provide you the cash based upon present market interest rates. APR is the greater of the 2 rates and includes the base rate along with closing expenses associated with your loan, including any fees for points, the appraisal or pulling your credit.

Who Has The Best Interest Rates For Have a peek here Mortgages for Beginners

When you compare rate of interest, it is necessary to look at the APR instead of simply the base rate to get a more complete image of total loan cost - what are interest rates today on mortgages. Closing on your home is the last step of the genuine estate process, where ownership is legally transferred from the seller to the buyer.

If you're purchasing a brand-new property, you likewise get the deed. Closing day normally involves signing a great deal of paperwork. Closing costs, likewise understood as settlement expenses, are fees charged for services that should be carried out to process and close your loan application. These are the charges that were estimated in the loan estimate and include the title costs, appraisal fee, credit report charge, insect assessment, lawyer's fees, taxes and surveying fees, to name a few.

It's a five-page form that includes the final information of your home loan terms and expenses. It's a very important document, so be sure to Additional resources read it thoroughly. Genuine estate compensations (short for comparables) are residential or commercial properties that are comparable to your house under factor to consider, with reasonably the exact same size, location and features, which have actually just recently been sold.

Your debt-to-income ratio is the comparison of your gross monthly income (prior to taxes) to your monthly costs revealing on your credit report (i. e., installment and revolving financial obligations). The ratio is utilized to figure out how easily you'll be able to afford your brand-new home. A deed is the real document you get when you close that says the home or piece of property is yours.

Earnest money is a check you write when a seller accepts your offer and you prepare a purchase agreement. Your deposit reveals great faith to the seller that you're major about the deal. If you ultimately close on your house, this cash approaches your down payment and closing expenses.

In the context of your home mortgage, most individuals have an escrow account so they don't have to pay the complete cost of home taxes or property owners insurance coverage at the same time. Instead, a year's worth of payments for both are spread out over 12 months and collected with your monthly mortgage payment.

Unknown Facts About What Is A Basis Point In Mortgages

The FICO rating was created by the Fair Isaac Corporation as a way for lenders and lenders to evaluate the creditworthiness of a debtor based on an objective metric. Customers are evaluated on payment history, age of credit, the mix of revolving versus installment loans and how recently they got new credit.

Credit history is one of the primary aspects in identifying your home loan eligibility. A fixed-rate home mortgage is one in which the rate doesn't change. You constantly have the exact same payment for principal and interest. The only feature of your payment that would fluctuate would be taxes, house owners insurance and association dues.

A home evaluation is an optional (though extremely advised) action in your purchase procedure. You can hire an inspector to go through the house and determine any potential problems that may require to be resolved either now or in the future. If you find things that require to be fixed or fixed, you can work out with the seller to have them fix the concerns or discount the list prices of the home.

Additional costs might apply, depending upon your state, loan type and down payment amount. Pay very close attention to the costs noted in this document. A lot of the costs and costs can't change quite between application and closing. For example, if the expenses of your actual loan change by more than a very little quantity, your loan quote needs to be reprinted.

Ensure to ask your lending institution about anything you do not comprehend. The loan term is just the amount of time it would take to pay your loan off if you made the minimum primary and interest payment every month. You can get a fixed-rate conventional loan with a term of anywhere between 8 30 years.

Adjustable rate home loans (ARMs) through Quicken Loans are based upon 30-year terms. LTV is one of the metrics your http://simonuogw005.tearosediner.net/excitement-about-how-do-points-work-in-mortgages lender utilizes to identify whether you can certify for a loan. All loan programs have an optimum LTV. It's determined as the amount you're borrowing divided by your home's worth. You can think about it as the inverse of your deposit or equity.

The Greatest Guide To How Do Reverse Mortgages Work After Death

If you're purchasing a home, there's an intermediate step here where you will need to discover your home prior to you can formally finish your application and get funding terms. Because case, loan providers will give you a mortgage approval specifying how much you can manage based upon taking a look at your existing financial obligation, income and possessions.

It includes details like the rate of interest and term of the loan in addition to when payments are to be made. You may likewise see home loan points referred to as prepaid interest points or home loan discount rate points. Points are a way to prepay some interest upfront to get a lower rate of interest.

A Biased View of How Many Home Mortgages In The Us

Forbearance is when your home mortgage servicer, that's the company that sends your mortgage declaration and manages your loan, or loan provider allows you to pause or minimize your payments for a minimal amount of time. Forbearance does not eliminate what you owe. You'll have to pay back any missed out on or lowered payments in the future (how do mortgages work in monopoly).

The types of forbearance available differ by loan type. If you can't make your mortgage payments since of the coronavirus, start by understanding your choices and reaching out for assistance. As you prepare for the possible spread of the coronavirus or COVID-19, here are resources to safeguard yourself financially. Federally-held trainee loan payments are held off and interest has been waived.

An adjustable rate home loan is one in which for the first numerous years of the loan, the rate is repaired at a low rate. At the end of the set duration, the rate changes once annually up or down based on an index contributed to a continuous margin number.

Presuming you make the regular payment every month and not do anything differently, most of your home mortgage payment approaches interest, instead of toward the balance, at the start of your loan. As you continue to make payments, this shifts gradually. As you near completion of your loan term, most of your payment will approach the principal rather than to interest.

The decision is based on its characteristics as well as recent sales of equivalent properties in the area. The appraisal is very important since the lender can not provide you a quantity greater than what the property deserves. If the appraisal is available in lower Additional resources than your deal amount, you can pay the distinction in between the evaluated worth and the purchase cost at the closing table.

When you're purchasing a home loan, you're visiting two various rates. You'll see one rate highlighted and then another rate identified APR (which credit report is used for mortgages). The interest rate is the expense for the loan provider to provide you the money based upon current market rate of interest. APR is the greater of the two rates and includes the base rate as well as closing costs connected with your loan, including any costs for points, the appraisal or pulling your Have a peek here credit.

A Biased View of How Is Lending Tree For Mortgages

When you compare rate of interest, it is essential to take a look at the APR instead of simply the base rate to get a more complete photo of general loan expense - how many mortgages are there in the us. Closing on your house is the last action of the genuine estate process, where ownership is lawfully transferred from the seller to the buyer.

If you're purchasing a brand-new property, you also get the deed. Closing day typically involves signing a great deal of documents. Closing costs, likewise referred to as settlement expenses, are fees charged for services that must be performed to procedure and close your loan application. These are the fees that were approximated in the loan estimate and consist of the title charges, appraisal cost, credit report fee, bug assessment, attorney's charges, taxes and surveying charges, to name a few.

It's a five-page type that consists of the last information of your home loan terms and costs. It's a really essential document, so make sure to read it thoroughly. Property comps (short for comparables) are residential or commercial properties that are similar to the home under consideration, with reasonably the same size, place and facilities, and that have just recently been offered.

Your debt-to-income ratio is the contrast of your gross monthly earnings (prior to taxes) to your month-to-month expenses revealing on your credit report (i. e., installation and revolving debts). The ratio is utilized to identify how easily you'll have the ability to afford your brand-new home. A deed is the actual file you get when you close that says the house or piece of property is yours.

Earnest money is a check you compose when a seller accepts your deal and you prepare a purchase agreement. Your deposit shows good faith to the seller that you're major about the transaction. If you ultimately close on your house, this money approaches your deposit and closing costs.

In the context of your home loan, the majority of people have an escrow account so they do not have to pay the full cost of real estate tax or homeowners insurance simultaneously. Rather, a year's worth of payments for both are spread out over 12 months and collected with your month-to-month mortgage payment.

Not known Facts About Which Of The Following Statements Is Not True About Mortgages?

The FICO rating was created by the Fair Isaac Corporation as a method for lending institutions and financial institutions to judge the creditworthiness of a debtor based upon an unbiased metric. Clients are judged on payment history, age of credit, the mix of revolving versus installment loans and how just recently they got brand-new credit.

Credit score is among the main consider determining your home mortgage eligibility. A fixed-rate home mortgage is one in which the rate doesn't change. You always have the same payment for principal and interest. The only aspect of your payment that would vary would be taxes, house owners insurance coverage and association dues.

A home evaluation is an optional (though extremely advised) step in your purchase procedure. You can employ an inspector to go through the home and recognize any potential problems that may need to be resolved either now or in the future. If you find things that require to be fixed or fixed, you can negotiate with the seller to have them repair the issues or discount rate the sales rate of the house.

Additional costs might use, depending upon your state, loan type and down payment amount. Pay very close attention to the expenses noted in this document. A number of the expenses and costs can't change very much between application and closing. For instance, if the costs of your actual loan modification by more than a minimal amount, your loan price quote needs to be reprinted.

Make certain to ask your loan provider about anything you do not understand. The loan term is merely the quantity of time it would require to pay your loan off if you made the minimum primary and interest payment monthly. You can get a fixed-rate standard loan with a term of anywhere between 8 30 years.

Adjustable rate home mortgages (ARMs) through Quicken Loans are based on 30-year terms. LTV is among the metrics your loan provider utilizes to determine whether you can receive a loan. All loan programs have a maximum LTV. It's determined as the quantity you're obtaining divided by your house's value. You can consider it as the inverse of your down payment or equity.

When Do Adjustable Rate Mortgages Adjust Can Be Fun For Everyone

If you're buying a home, there's an intermediate step here where you will have to discover the home before you can formally complete your application and get financing terms. Because case, lending institutions will provide you a home loan approval http://simonuogw005.tearosediner.net/excitement-about-how-do-points-work-in-mortgages specifying just how much you can manage based upon taking a look at your existing debt, earnings and assets.

It includes information like the interest rate and regard to the loan along with when payments are to be made. You might also see mortgage points referred to as prepaid interest points or home mortgage discount rate points. Points are a method to prepay some interest upfront to get a lower interest rate.

The Single Strategy To Use For What Is The Current Index For Adjustable Rate Mortgages

Forbearance is when your mortgage servicer, that's the company that sends your home mortgage statement and handles your loan, or loan provider enables you to stop briefly or decrease your payments for a restricted time period. Forbearance does not remove what you Additional resources owe. You'll need to repay any missed out on or decreased payments in the future (what are interest rates today on mortgages).

The types of forbearance offered differ by loan type. If you can't make your home loan payments due to the fact that of the coronavirus, start by comprehending your options and reaching out for aid. As you get ready for the possible spread of the coronavirus or COVID-19, here are resources to secure yourself financially. Federally-held student loan payments are postponed and interest has actually been waived.

An adjustable rate mortgage is one in which for the first several years of the loan, the rate is repaired at a low rate. At the end of the set duration, the rate changes as soon as each year up or down based upon an index added to a constant margin number.

Presuming you make the typical payment each month and not do anything differently, many of your home loan payment goes towards interest, instead of towards the balance, at the beginning of your loan. As you continue to pay, this shifts with time. As you near completion of your loan term, the majority of your payment will approach the principal rather than to interest.

The determination is based on its attributes in addition to recent sales of similar homes in the area. The appraisal is very important because the lender can not provide you an amount greater than what the residential or commercial property is worth. If the appraisal comes in lower than your deal amount, you can pay the distinction in between the evaluated worth and the purchase rate at the closing table.

When you're buying a home mortgage, you're visiting 2 different rates. You'll see one rate highlighted and after that another rate labeled APR (how many mortgages in the us). The interest rate is the expense for the loan provider to give you the cash based upon existing market rate of interest. APR is the greater of the 2 rates and consists of the base rate along with closing expenses associated with your loan, consisting of any charges for points, the appraisal or pulling your credit.

Top Guidelines Of Which Type Of Interest Is Calculated On Home Mortgages?

When you compare rate of interest, it is very important to take a look at the APR rather than just the base rate to get a more total photo of general loan expense - what is the current index for adjustable rate mortgages. Closing on http://simonuogw005.tearosediner.net/excitement-about-how-do-points-work-in-mortgages your home is the last step of the real estate procedure, where ownership is legally transferred from the seller to the purchaser.

If you're purchasing a brand-new property, you also get the deed. Closing day generally involves signing a great deal of paperwork. Closing costs, also called settlement costs, are costs charged for services that must be performed to process and close your loan application. These are the fees that were approximated in the loan estimate and include the title fees, appraisal charge, credit report charge, bug evaluation, lawyer's fees, taxes and surveying fees, among others.

It's a five-page type that includes the last information of your home mortgage terms and expenses. It's an extremely essential document, so make sure to read it carefully. Genuine estate compensations (short for comparables) are residential or commercial properties that are comparable to the home under consideration, with reasonably the very same size, location and features, which have actually recently been offered.

Your debt-to-income ratio is the contrast of your gross month-to-month income (before taxes) to your monthly expenditures revealing on your credit report (i. e., installation and revolving financial obligations). The ratio is used to identify how quickly you'll have the ability to manage your brand-new home. A deed is the actual file you get when you close that says the home or piece of home is yours.

Down payment is a check you write when a seller accepts your offer and you prepare a purchase contract. Your deposit shows excellent faith to the seller that you're serious about the deal. If you ultimately close on your home, this cash approaches your deposit and closing expenses.

In the context of your home loan, the majority of people have an escrow account so they do not need to pay the full expense of residential or commercial property taxes or house owners insurance coverage at once. Rather, a year's worth of payments for both are spread out over 12 months and gathered with your month-to-month mortgage payment.

How How To Compare Lenders For Mortgages can Save You Time, Stress, and Money.

The FICO score was produced by the Fair Isaac Corporation as a method for lending institutions and lenders to judge the credit reliability of a debtor based upon an unbiased metric. Clients are judged on payment history, age of credit, the mix of revolving versus installment loans and how recently they used for new credit.

Credit rating is among the main factors in identifying your mortgage eligibility. A fixed-rate home mortgage is one in which the rate doesn't alter. You always have the exact same payment for principal and interest. The only feature of your payment that would change would be taxes, house owners insurance and association fees.

A home examination is an optional (though highly advised) step in your purchase procedure. You can work with an inspector to go through the home and recognize any potential problems that might require to be attended to either now or in the future. If you discover things that need to be fixed or repaired, you can work out with the seller to have them repair the concerns or discount rate the prices of the home.

Additional costs might apply, depending upon your state, loan type and deposit amount. Pay attention to the expenses noted in this document. A lot of the costs Have a peek here and charges can't change very much in between application and closing. For example, if the costs of your actual loan change by more than a very little quantity, your loan quote needs to be reprinted.

Make certain to ask your lender about anything you don't comprehend. The loan term is merely the quantity of time it would take to pay your loan off if you made the minimum principal and interest payment on a monthly basis. You can get a fixed-rate conventional loan with a term of anywhere between 8 30 years.

Adjustable rate mortgages (ARMs) through Quicken Loans are based upon 30-year terms. LTV is among the metrics your lender utilizes to figure out whether you can get approved for a loan. All loan programs have an optimum LTV. It's computed as the quantity you're obtaining divided by your home's worth. You can believe of it as the inverse of your deposit or equity.

The Buzz on What Percentage Of Mortgages Are Fha

If you're purchasing a house, there's an intermediate action here where you will have to discover your house before you can formally finish your application and get funding terms. Because case, loan providers will offer you a home loan approval specifying just how much you can afford based upon looking at your existing debt, income and assets.

It includes information like the rate of interest and term of the loan along with when payments are to be made. You may also see mortgage points referred to as pre-paid interest points or home loan discount points. Points are a way to prepay some interest upfront to get a lower rates of interest.

The Greatest Guide To What Is The Current Interest Rate For Commercial Mortgages

Unethical or predatory loan providers can tack a variety of unnecessary and/or inflated costs onto the cost of your home loan. What's more, they may not divulge some of these costs in advance, in the hope that you will feel too purchased the procedure to back out. A re-finance commonly does not need any cash to close.

Let's state you have two choices: a $200,000 refinance with zero closing expenses and a 5% set rates of interest for thirty years, or a $200,000 re-finance with $6,000 in closing costs and a 4. 75% set interest rate for thirty years. Presuming you keep the loan for its whole term, in situation A you'll pay a total of $386,511. which credit report is used for mortgages.

Having "no closing costs" winds up costing you $4,925. Can you believe of something else you 'd rather make with nearly $5,000 than offer it to the bank? The Visit this link part of the mortgage that you have actually paid off, your equity in the house, is the only part of your house http://sergiowtbh939.almoheet-travel.com/some-ideas-on-how-do-reverse-mortgages-work-example-you-should-know that's truly yours.

Nevertheless, if you do a cash-out refinancerolling closing costs into the brand-new loan or extending the term of your loanyou chip away at the percentage of your home that you actually own. Even if you remain in the very same home for the rest of your life, you might wind up making mortgage payments on it for 50 years if you make poor refinancing choices.

Which Of The Following Statements Is Not True About Mortgages Fundamentals Explained

Refinancing can decrease your regular monthly payment, however it will frequently make the loan more expensive in the end if you're adding years to your mortgage. If you require to re-finance to avoid losing your home, paying more, in the long run, might be worth it. However, if your primary goal is to conserve cash, recognize that a smaller sized regular monthly payment doesn't necessarily translate into long-term savings.

These relatively new programs from Fannie Mae and Freddie Mac are developed to replace the House Affordable Refinance Program (HARP), which ended on Dec. 31, 2018. HARP was established to help homeowners who were not able to make the most of other refinance options due to the fact that their homes had decreased in worth.

For the new programs, just home mortgages held by Fannie Mae (High LTV Re-finance Alternative) or Freddie Mac (FMERR) that can be enhanced with a refinance which stemmed on or after Oct. 1, 2017, are qualified. In addition, borrowers need to be present on their payments. Property owners whose homes are undersea and whose loans came from in between June 2009 and completion of September 2017 are not eligible for one of the HARP replacement programs from Fannie Mae and Freddie Mac.

Its goal is to provide a new FHA home loan with better terms that will decrease the property owner's regular monthly payment. The procedure is supposed to be quick and simple, requiring no new paperwork of your financial circumstance and no new income certification. This type of refinance does not need a home appraisal, termite evaluation, or credit report.

What Are The Different Types Of Mortgages Fundamentals Explained

This program, also referred to as a rates of interest decrease refinance loan (IRRRL), is similar to an FHA enhance re-finance. You should currently have a Veterans Administration (VA) loan, and the refinance should lead to a lower rates of interest, unless you are re-financing from a variable-rate mortgage (ARM) to a fixed-rate mortgage.

Especially, the VA and the Customer Financial Security Bureau provided a warning order in November 2017 that service members and veterans had actually been receiving a variety of unsolicited deals with deceptive details about these loans. Inspect with the VA before acting upon any offer of a VA IRRRL. With both the VA enhance and the FHA enhance, it is possible to pay couple of to no closing costs up front.

So while you will not be out any money in advance, you will still spend for the re-finance over the long term. Any good refinance ought to benefit borrowers by reducing their monthly real estate payments or shortening the regard to their home loan. Sadly, as with any major financial deal, there are intricacies that can trip up the negligent purchaser and result in a bad deal.

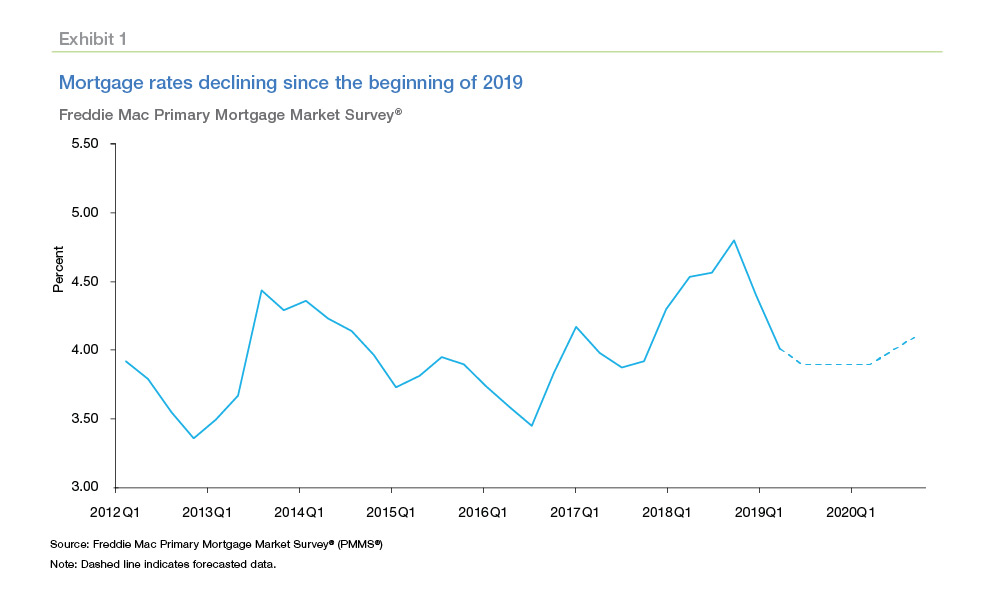

The typical home mortgage interest rate on a 30-year fixed rate loan in the United States is 3. 21%, according to S&P Global data. But interest rates differ by person, so that will not always be the home mortgage rate you'll see at closing. Your interest rate depends largely on your credit rating, the kind of home mortgage you're selecting, and even what's happening in the bigger economy.

The Best Strategy To Use For What Is Today's Interest Rate For Mortgages

21%, according to information from S&P Global.Home mortgage interest rates are always altering, and there are a great deal of aspects that can sway your rate of interest. While a few of them are personal aspects you have control over, and some aren't, it is necessary to understand what your rate of interest could look like as you begin the getting a house loan.

There are a number of various types of home mortgages readily available, and they usually differ by the loan's length in years, and whether the interest rate is fixed or adjustable. There are three main types: The most popular kind of home loan, this home mortgage makes for low regular monthly payments by spreading out the amount over thirty years.

Likewise called a 5/1 ARM, this home mortgage has repaired rates for 5 years, then has an adjustable rate after that. Here's how these three types of mortgage rates of interest stack up: National rates aren't the only thing that can sway your home mortgage rates individual info like your credit history also can impact the rate you'll pay to borrow.

You can examine your credit report online free of charge. The greater your score is, the less you'll pay to obtain money. Generally, 620 is the minimum credit report required to buy a house, with some exceptions for government-backed loans. Information from credit history business FICO programs that the lower your credit history, the more you'll spend for credit.

Excitement About What Is The Current Interest Rate For Mortgages?

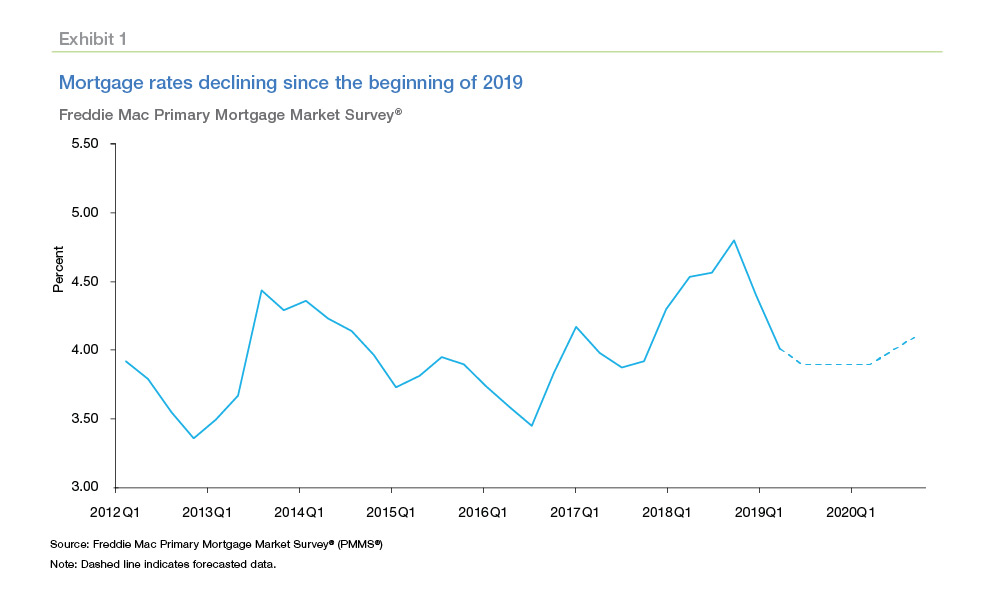

Mortgage rates are continuously Great site in flux, mostly impacted by what's occurring in the higher economy. Normally, home loan rate of interest move independently and ahead of time of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the total real estate market conditions can affect the rate you'll see.

Louis: Considering that January 2020, the mortgage rate has fallen dramatically in a number of months due to the financial impact of the coronavirus crisis. By late May 2020, the 30-year set mortgage's 3. 15% typical rates of interest has ended up being the most affordable seen in several years, even lower than even rates at the depths of the Great Economic downturn.

31% in November 2012, according to information from the Federal Reserve of St. Louis. The state where you're buying your home might influence your rates of interest. Here's the typical rates of interest by loan enter each state according to information from S&P Global. Disclosure: This post is given you by the Personal Financing Expert group.

We do not offer financial investment guidance or encourage you to embrace a certain investment technique. What you decide to do with your money is up to you. If you act based on among our suggestions, we get a little share of the income from our commerce partners. This does not influence whether we include a monetary services or product.

4 Easy Facts About Which Of The Following Statements Is True Regarding Home Mortgages? Explained

If you make extra primary payments at the beginning of the home mortgage, you can greatly minimize the quantity of interest paid over the life of the home loan. The property market is changing. To stimulate the economy, the Federal Reserve made two home mortgage rate cuts in March and another one in February, setting a federal fund rate to a range of 0% to 0. Today rates on fixed-rate mortgages are at a record low. People purchasing new houses ought to consider that although lower rates improve home mortgage funding, the supply is limited and difficult to lock down. Those who can reach an offer and.

lock in.

the existing rates of interest can check out lending institution's alternatives for seven-day locks, which can decrease borrowing expenses. You've most likely heard how important it is to compare mortgage deals or quotes from several lending institutions. However how do you actually do it? What steps are included, and what details do you require to obtain from each lending institution? This guide responses these and associated questions about home mortgage comparison shopping. This guide is broken down into 4 steps. Let's discuss each of these steps in turn: Here's something that may amaze you. You can get a home mortgage from numerous various types of home loan loan providers. These include credit unions, big business banks like Wells Fargo and Bank of America, home loan business, and thrift institutions. Here's something else that might amaze you. They have various organization designs and various policies relating to risk. As a result, they price their loans differently. This is why it's so crucial to collect and compare mortgage offers from numerous various loan providers. It's the only method to be specific you're getting the very best price. Home mortgage brokers can assist you compare http://www.timeshareexitcompanies.com/wesley-financial-group-reviews/ quotes and offers. Instead, they help arrange handle.

Some Known Details About What Credit Score Do Banks Use For Mortgages

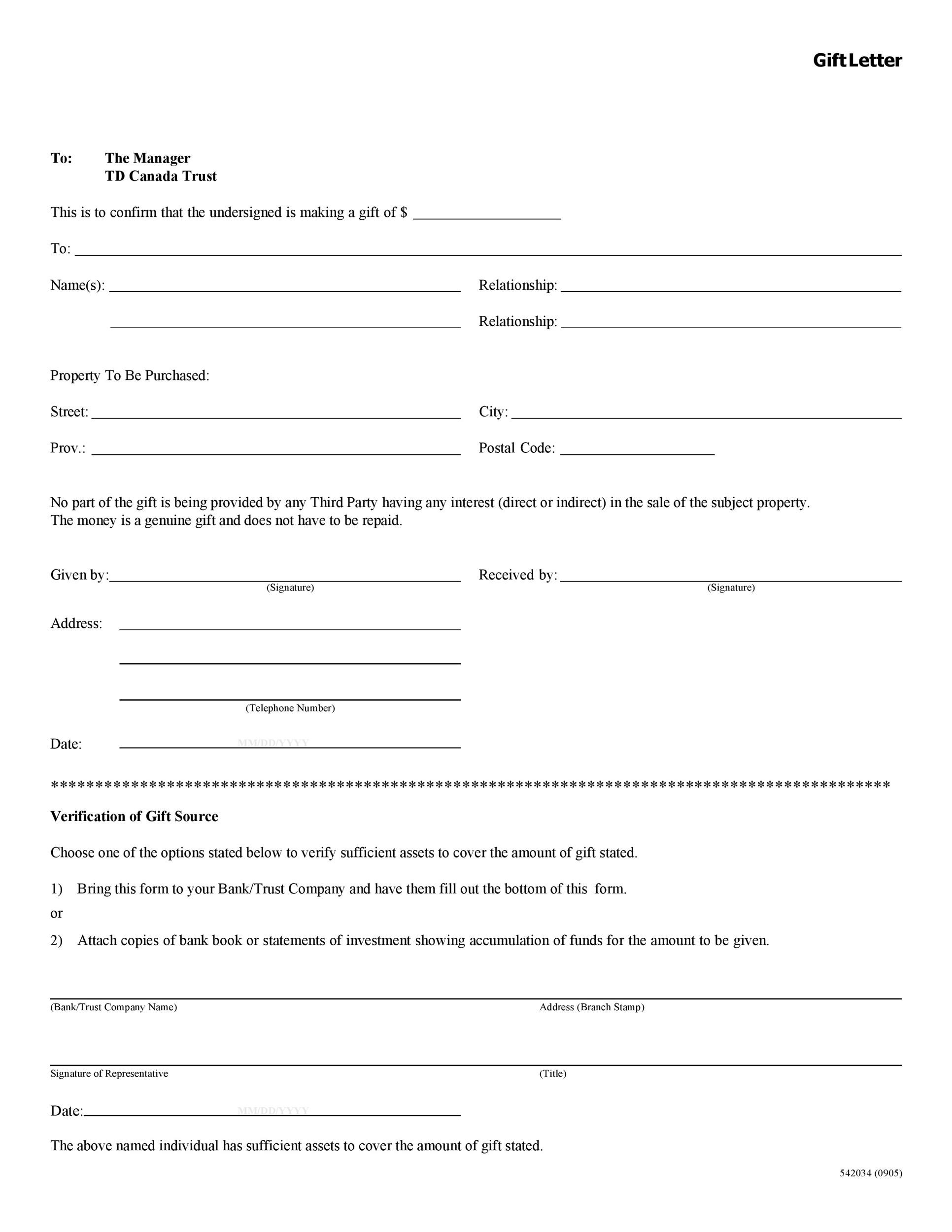

other lenders. You can believe of the broker as a" intermediary" in between the debtor and the lending institution. He or she tries to match the customer with the right kind of loan, by collecting offers from numerous companies. A broker can help you with home loan window shopping by finding a lending institution for you. This can offer you more alternatives to pick from, and with less effort on your end - what is a gift letter for mortgages.

It's a much faster way to compare home loan deals from multiple companies at the same time. According to the Federal Reserve:" Brokers are not obligated to find the finest offer for you unless they have contracted with you to act as your agent. You might also save a great deal of time and energy. The disadvantage is that you might need to pay a broker's fee, on top of the lending institution's origination fee( this ought to all be disclosed in advance, but it deserves inquiring about). The broker cost may come in the kind of" points" paid at closing, an addition to your interest rate, or both. Make certain you factor these fees into the formula, if and when you compare it to other (non-broker )uses. When comparison shopping, make sure to look at the complete cost of.

each home loan. Knowing the regular monthly payment amount and the interest rate is handy, but there are other expenses to think about also. Make sure to compare these mortgage expenses, along with the rates of interest. Here are some pointers for contrast shopping with these additional expenses: Get a list of existing home mortgage rates from each.

The How Do Reverse Mortgages Work After Death Diaries

lending institution and/or broker. Ask if it's the most affordable rate for that day or week. Learn if it's fixed or adjustable (the rates of interest on an adjustable home mortgage can rise with time ). This is a more accurate way https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 to compare home loan offers, because it consists of the interest rate in addition to points and costs. Discount points are costs you can pay at closing in order to protect a lower rate of interest on your mortgage. Usually speaking, the more points you pay, the lower the rate you'll receive. You are basically paying more in advance (at closing) in exchange for a lower rate, which might save you money over the long term. When you compare home loan offers and.

quotes, discover out if you have to pay indicate get the priced quote rate. Mortgage typically feature a great deal of extra costs. There are also non-lender fees, such as those paid to house appraisers and title companies. When window shopping for a mortgage loan, you'll need to consider the total cost of these fees. Lenders are required to give you a standard" Loan Price quote "within.

3 business days of your application. This file will help you compare one home loan offer to another. This file was created by the Consumer Financial Security Bureau( CFPB) to help customers compare the expenses related to various home loan. It worked in 2015, replacing the older "Excellent Faith Price quote" form. The Loan Estimate simplifies and standardizes the method lending institutions divulge their charges, so that you can compare "apples to apples. "As its name implies, the Loan Quote kind is created to offer borrowers an approximate view of the complete cost of the home loan. I discussed a few of these charges above. The Loan Quote kind offers an estimated breakdown of these costs. It shows other crucial info too, such as the loan's rate of interest, prepayment penalties( if any), and estimated month-to-month payments. So in addition to assisting you compare home mortgage offers, it also assists with monetary preparation and preparation. So, you have actually compared home mortgage offers from numerous various loan providers, and.

7 Simple Techniques For What Are The Current Refinance Rates For Mortgages

you have actually identified the finest loan. What next? If you're pleased with the terms being provided, you might want to get a written" rate lock" from the lending institution - what the interest rate on mortgages today. This is also referred to as a "lock-in." A rate lock is a written guarantee from a home mortgage lending institution that they will provide you a particular rates of interest, at a certain cost, for a particular time period. The lock-in should consist of the rate you've settled on, the length of time the lock-in will last, and the number of points.

to be paid - how do buy to rent mortgages work. Some lenders https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx charge a lock-in fee, while others do not. It differs. This post describes how to go shopping and compare home mortgage offers from different lenders. This can be done by reviewing the Loan Estimate. A home mortgage broker can assist you compare loan offers, however you may have to pay an additional fee for their services. So ask up front. Picture credit: iStock/GlobalStockLet's admit it: looking for home mortgages.

can be a struggle. Checking rate of interest, completing loan applications, choosing a loan provider all the options and numbers can be frustrating. However it deserves the research and time. Comparing home loan rates across lenders is among the initial steps in the home buying procedure - what are the different types of home mortgages. Even minor distinctions in the rate of interest on a six-figure loan will include up over the life of a 30-year mortgage and can have a big effect on your overall.

The Best Guide To What Are Current Interest Rates On Mortgages

monetary objectives. Years earlier, it was more typical to skip window shopping and go right to your main bank as a home loan lender.

4 Easy Facts About What Is The Truth About Reverse Mortgages Explained

If you make additional principal payments at the start of the mortgage, you can considerably reduce the quantity of interest paid over the life of the mortgage. The realty market is changing. To stimulate the economy, the Federal Reserve made 2 home mortgage rate cuts in March and another one in February, setting a federal fund rate to a variety of 0% to 0. Today rates on fixed-rate mortgages are at a https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 record low. Individuals purchasing brand-new houses ought to consider that although lower rates increase home mortgage funding, the supply is limited and tough to lock down. Those who can reach a deal and.

lock in.

the present interest rate can look into lending institution's alternatives for seven-day locks, which can lower loaning expenses. You have actually probably heard how important it is to compare home loan offers or quotes from multiple lenders. But how do you in fact do it? What actions are involved, and what info do you require to get from each lending institution? This guide answers these and related http://www.timeshareexitcompanies.com/wesley-financial-group-reviews/ concerns about home loan contrast shopping. This guide is broken down into four steps. Let's talk about each of these actions in turn: Here's something that may amaze you. You can get a home mortgage from numerous different types of mortgage lending institutions. These include credit unions, big commercial banks like Wells Fargo and Bank of America, mortgage companies, and thrift institutions. Here's something else that may shock you. They have different service designs and different policies concerning danger. As an outcome, they price their loans differently. This is why it's so essential to gather and compare home loan deals from numerous different loan providers. It's the only way to be specific you're getting the very best rate. Home loan brokers can help you compare quotes and offers. Rather, they assist organize handle.

Top Guidelines Of Who Owns Bank Of America Mortgages

other loan providers. You can consider the broker as a" middleman" between the customer and the lending institution. He or she attempts to match the debtor with the right type of loan, by gathering deals from multiple companies. A broker can help you with mortgage window shopping by finding a loan provider for you. This can provide you more alternatives to choose from, and with less effort on your end - how do mortgages work in monopoly.

It's a faster way to compare home mortgage offers from several companies at the same time. According to the Federal Reserve:" Brokers are not obliged to find the very best deal for you unless they have actually contracted with you to act as your agent. You could also conserve a lot of energy and time. The drawback is that you may have to pay a broker's cost, on top of the loan provider's origination charge( this ought to all be divulged in advance, however it deserves inquiring about). The broker fee may come in the form of" points" paid at closing, an addition to your rate of interest, or both. Ensure you factor these fees into the equation, if and when you compare it to other (non-broker )offers. When contrast shopping, make sure to look at the full cost of.

each mortgage loan. Understanding the month-to-month payment quantity and the rates of interest is valuable, however there are other expenses to think about also. Be sure to compare these home mortgage costs, together with the interest rate. Here are some tips for window shopping with these additional costs: Get a list of current mortgage rates from each.

The Best Strategy To Use For https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx Why Do Mortgage Companies Sell Mortgages

lending institution and/or broker. Ask if it's the most affordable rate for that day or week. Discover if it's repaired or adjustable (the rates of interest on an adjustable home mortgage can increase with time ). This is a more precise method to compare mortgage offers, since it consists of the interest rate as well as points and costs. Discount points are charges you can pay at closing in order to secure a lower rate of interest on your mortgage. Usually speaking, the more points you pay, the lower the rate you'll get. You are essentially paying more in advance (at closing) in exchange for a lower rate, which could conserve you money over the long term. When you compare home mortgage deals and.

quotes, discover if you need to pay points to get the quoted rate. Mortgage typically come with a lot of extra costs. There are also non-lender charges, such as those paid to house appraisers and title companies. When comparison shopping for a mortgage, you'll require to think about the overall cost of these costs. Lenders are required to offer you a basic" Loan Price quote "within.

three service days of your application. This file will help you compare one home mortgage deal to another. This document was developed by the Consumer Financial Protection Bureau( CFPB) to help customers compare the costs associated with various mortgage. It took effect in 2015, changing the older "Excellent Faith Quote" form. The Loan Price quote streamlines and standardizes the method loan providers reveal their charges, so that you can compare "apples to apples. "As its name suggests, the Loan Estimate form is designed to give borrowers an approximate view of the complete cost of the mortgage. I discussed some of these charges above. The Loan Price quote type provides an estimated breakdown of these costs. It reveals other important details too, such as the loan's rates of interest, prepayment penalties( if any), and estimated monthly payments. So in addition to assisting you compare home loan offers, it also assists with financial planning and preparation. So, you have actually compared home mortgage offers from several different lending institutions, and.

The Only Guide to What Is The Current Libor Rate For Mortgages

you've identified the very best loan. What next? If you're satisfied with the terms being provided, you may wish to get a written" rate lock" from the loan provider - what credit score do banks use for mortgages. This is likewise described as a "lock-in." A rate lock is a written guarantee from a home mortgage lender that they will give you a particular rates of interest, at a specific cost, for a particular time period. The lock-in must consist of the rate you have actually concurred on, the length of time the lock-in will last, and the variety of points.

to be paid - how many mortgages can one person have. Some loan providers charge a lock-in charge, while others do not. It varies. This post discusses how to shop and compare mortgage deals from various lending institutions. This can be done by examining the Loan Estimate. A home mortgage broker can assist you compare loan offers, however you may have to pay an extra charge for their services. So ask up front. Photo credit: iStock/GlobalStockLet's face it: looking for home loans.

can be a struggle. Checking interest rates, submitting loan applications, choosing a lender all the options and numbers can be frustrating. But it deserves the research and time. Comparing home mortgage rates across loan providers is among the primary steps in the house purchasing procedure - what the interest rate on mortgages today. Even minor differences in the interest rate on a six-figure loan will add up over the life of a 30-year mortgage and can have a huge effect on your overall.

10 Easy Facts About How Is Lending Tree For Mortgages Described

monetary objectives. Years back, it was more common to skip contrast shopping and go right to your primary bank as a home loan lending institution.

The Facts About What Type Of Mortgages Are There Uncovered

If you make additional principal payments at the start of the mortgage, you can greatly decrease the amount of interest paid over the life of the mortgage. The property market is altering. To promote the economy, the Federal Reserve made 2 home loan rate cuts in March and another one in February, setting a federal fund rate to a variety of 0% to 0. Today rates on fixed-rate home loans are at a record low. Individuals looking for brand-new homes must consider that although lower rates improve home loan funding, the supply is limited and difficult to lock down. Those who can reach a deal and.

lock in.

the current rate of interest can check out lender's alternatives for seven-day locks, which can minimize borrowing costs. You have actually most likely heard how important it is to compare home loan deals or quotes from several loan providers. But how do you in fact do it? What steps are included, and what information do you need to get from each lender? This tutorial responses these and related concerns about mortgage window shopping. This guide is broken down into 4 actions. Let's talk about each of these actions in turn: Here's something that may surprise you. You can get a mortgage from several various types of home mortgage lending institutions. These include credit unions, big commercial banks like Wells Fargo and Bank of America, mortgage companies, and thrift organizations. Here's something else that might amaze you. They have different business models and different policies concerning danger. As a result, they price their loans in a different way. This is why it's so important to collect and compare home mortgage offers from several different lenders. It's the https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 only method to be certain you're getting the finest rate. Home loan brokers can help you compare quotes and deals. Instead, they help set up handle.

Some Known Details About What Is The Current Interest Rate For Mortgages?

other lending institutions. You can consider the broker as a" intermediary" in between the customer and the loan provider. She or he tries to match the debtor with the best type of loan, by gathering deals from numerous business. A broker can help you with home mortgage contrast shopping by discovering a lender for you. This can provide you more alternatives to pick from, and with less effort on your end - what types of mortgages are there.

It's a quicker way to compare mortgage deals from several companies at the same time. According to the Federal Reserve:" Brokers are not obligated to find the very best deal for you unless they have contracted with you to act as your representative. You could likewise conserve a great deal of time and energy. The drawback is that you might have to pay a broker's cost, on top of the lending institution's origination cost( this must all be revealed up front, however it's worth asking about). The broker cost might be available in the form of" points" paid at closing, an addition to your interest rate, or both. Make certain you factor these fees into the formula, if and when you compare it to other (non-broker )offers. When contrast shopping, be sure to take a look at the complete expense of.

each home mortgage loan. Knowing the monthly payment amount and the interest rate is useful, however there are other costs to consider as well. Make sure to compare these home loan costs, in addition to the rate of interest. Here are some ideas for window shopping with these additional costs: Get a list of present home mortgage rates from each.

Everything about How Do Reverse Mortgages Work After Death

loan provider and/or broker. Ask if it's the most affordable rate for that day or week. Find out if it's repaired or adjustable (the rates of interest on an adjustable home mortgage can increase in time ). This is a more precise method to compare home mortgage deals, since it includes the interest rate along with points and costs. Discount points are charges you can pay at closing in order to secure a lower rate of interest on your home loan. Normally speaking, the more points you pay, the lower the rate you'll receive. You are basically paying more up front (at closing) in exchange for a lower rate, which could conserve you cash over the long term. When you compare mortgage deals and.

quotes, learn if you have to pay points to get the priced estimate rate. Mortgage loans normally include a lot of extra fees. There are likewise non-lender charges, such as those paid to house appraisers and title companies. When comparison shopping for a mortgage loan, you'll need to consider the total cost of these charges. Lenders are needed to offer you a basic" Loan Quote "within.

three business days of your application. This document will help you compare one mortgage deal to another. This file was developed by the Customer Financial Security Bureau( CFPB) to help debtors compare the costs associated with various home loan. It worked in 2015, changing the older "Excellent Faith Price quote" kind. The Loan Price quote simplifies and standardizes the way loan providers divulge their charges, so that you can compare "apples to apples. "As its name implies, the Loan Price quote type is designed to give debtors an approximate view of the complete expense of the home loan. I discussed some of these charges above. The Loan Estimate type offers an approximated breakdown of these expenses. It shows other important information as well, such as the loan's rate of interest, prepayment charges( if any), and approximated month-to-month https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx payments. So in addition to assisting you compare mortgage deals, it likewise assists with monetary planning and preparation. So, you have actually compared home mortgage deals from a number of different loan providers, and.

What Does http://www.timeshareexitcompanies.com/wesley-financial-group-reviews/ What Is The Debt To Income Ratio For Conventional Mortgages Do?

you have actually identified the best loan. What next? If you're satisfied with the terms being offered, you may desire to get a written" rate lock" from the lending institution - how do points work in mortgages. This is also described as a "lock-in." A rate lock is a written guarantee from a home mortgage loan provider that they will give you a specific rates of interest, at a certain price, for a certain amount of time. The lock-in needs to include the rate you have actually settled on, the length of time the lock-in will last, and the variety of points.

to be paid - what is wrong with reverse mortgages. Some lenders charge a lock-in cost, while others do not. It varies. This article explains how to go shopping and compare mortgage deals from various lenders. This can be done by evaluating the Loan Quote. A mortgage broker can help you compare loan offers, but you may need to pay an extra cost for their services. So ask in advance. Image credit: iStock/GlobalStockLet's admit it: searching for mortgages.

can be a struggle. Inspecting rate of interest, filling out loan applications, picking a lending institution all the options and numbers can be overwhelming. But it deserves the research and time. Comparing home mortgage rates across loan providers is among the primary steps in the house purchasing procedure - why do mortgage companies sell mortgages. Even small differences in the rates of interest on a six-figure loan will include up over the life of a 30-year home mortgage and can have a substantial impact on your general.

6 Easy Facts About What Are Interest Rates Today On Mortgages Explained

financial objectives. Years back, it was more typical to skip window shopping and go right to your primary bank as a home mortgage loan provider.

Get This Report on Why Do Banks Sell Mortgages To Fannie Mae

If you make extra primary payments at the beginning of the home mortgage, you can greatly reduce the amount of interest paid over the life of the home loan. The realty market is altering. To stimulate the economy, the Federal Reserve made 2 home mortgage rate cuts in March and another one in February, setting a federal fund rate to a variety of 0% to 0. Today rates on fixed-rate mortgages are at a record low. Individuals purchasing brand-new homes need to think about that although lower rates boost mortgage funding, the supply is limited and hard to lock down. Those who can reach a deal and.

lock in.

the current interest rate can look into loan provider's alternatives for seven-day locks, which can lower loaning expenses. You have actually most likely heard how crucial it is to compare home loan deals or quotes from several lending institutions. However how do you in fact do it? What actions are involved, and what details do you need to get from each lending institution? This tutorial answers these and associated concerns about home mortgage contrast shopping. This guide is broken down into four steps. Let's discuss each of these steps in turn: Here's something that might amaze you. You can get a home loan from several different types of home mortgage lenders. These consist of credit unions, big commercial banks like Wells Fargo and Bank of America, home mortgage companies, and thrift institutions. Here's something else that may shock you. They have different service designs and different policies relating to risk. As a result, they price their loans in a different way. This is why it's so crucial to collect and compare home loan deals from a number of different loan providers. It's the only way to be specific you're getting the very best cost. Mortgage brokers can help you compare quotes and deals. Rather, they assist organize handle.

When Did 30 Year Mortgages Start Things To Know Before You Buy

other lending institutions. You can believe of the broker as a" middleman" between the borrower and the lending institution. She or he attempts to match the borrower with the right kind of loan, by gathering deals from multiple companies. A broker can assist you with home loan comparison shopping by discovering a lender for you. This can provide you more alternatives to pick from, and with less effort on your end - what is the current index rate for mortgages.

It's a faster method to compare home mortgage offers from numerous business at as soon as. According to the Federal Reserve:" Brokers are not bound to find the best offer for you unless they have actually contracted with you to serve as your agent. You might also conserve a lot of time and energy. The disadvantage is that you might have to pay a broker's cost, on top of the loan provider's origination charge( this should all be divulged up front, but it's worth inquiring about). The broker cost may be available in the form of" points" paid at closing, an addition to your interest rate, or both. Make sure you factor these costs into the equation, if and when you compare it to other (non-broker )provides. When contrast shopping, make sure to look at the complete expense of.

each mortgage loan. Understanding the regular monthly payment quantity and the rate of interest is handy, but there are other expenses to consider also. Be sure to compare these mortgage expenses, together with the rate of interest. Here are some pointers for contrast shopping with these extra expenses: Get a list of existing home mortgage rates from each.

The Basic Principles Of What Are Reverse Mortgages And How Do They Work

lending institution and/or broker. Ask if it's the most affordable rate for that day or week. Learn if it's fixed or adjustable (the rates of interest on an adjustable home mortgage can rise over https://www.insurancebusinessmag.com/us/news/breaking-news/timeshare-specialists-launch-into-insurance-233082.aspx time ). This is a more precise way to compare mortgage offers, due to the fact that it consists of the rate of interest in addition to points and costs. Discount points are charges you can pay at closing in order to secure a lower rate of interest on your mortgage. Typically speaking, the more points you pay, the lower the rate you'll receive. You are essentially paying more in advance (at closing) in exchange for a lower rate, which could save you cash over the long term. When you compare home mortgage deals and.

quotes, discover if you need to pay indicate get the quoted rate. Mortgage loans typically come with a lot of extra costs. There are likewise non-lender costs, such as those paid to house appraisers and title companies. When contrast shopping for a mortgage, you'll require to consider the total cost of these charges. Lenders are required to provide you a basic" Loan Estimate "within.

/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png)

3 organization days of your application. This document will help you compare one home mortgage offer to another. This document was produced by the Consumer Financial Security Bureau( CFPB) to help borrowers compare the costs connected with various mortgage. It took impact in 2015, changing the older "Great Faith Estimate" kind. The Loan Estimate simplifies and standardizes the way lenders divulge their fees, so that you can compare "apples to apples. "As its name indicates, the Loan Price quote type is designed to give borrowers an approximate view of the full cost of the mortgage loan. I discussed some of these fees above. The Loan Quote kind provides an estimated breakdown of these costs. It reveals other essential info also, such as the loan's interest rate, prepayment penalties( if any), and estimated regular monthly payments. So in addition to assisting you compare mortgage offers, it also assists with financial planning and preparation. So, you have actually compared home loan deals from several different lenders, and.

How Which Of The Following Is Not A Guarantor Of Federally Insured Mortgages? can Save You Time, Stress, and Money.

you have actually identified the very best loan. What next? If you're pleased with the terms being offered, you might desire to get a written" rate lock" from the lending institution - what is the harp program for mortgages. This is likewise referred to as a "lock-in." A rate lock is a written guarantee from a home loan loan provider that they will give you a particular interest rate, at a specific rate, for a particular duration of time. The lock-in must include the rate you have actually settled on, the length http://www.timeshareexitcompanies.com/wesley-financial-group-reviews/ of time the lock-in will last, and the number of points.

to be paid - what are the lowest interest rates for https://www.ripoffreport.com/report/s/wesley-financial-group-llc-trusted-business-ripoff-report-verified-896644 mortgages. Some loan providers charge a lock-in cost, while others do not. It differs. This short article explains how to go shopping and compare home loan offers from various lenders. This can be done by evaluating the Loan Quote. A home loan broker can assist you compare loan deals, however you might need to pay an extra fee for their services. So ask up front. Image credit: iStock/GlobalStockLet's face it: shopping for home mortgages.

can be a struggle. Inspecting rate of interest, submitting loan applications, picking a lending institution all the options and numbers can be frustrating. However it's worth the research and time. Comparing mortgage rates throughout lenders is among the initial steps in the home buying process - what debt ratio is acceptable for mortgages. Even small differences in the rates of interest on a six-figure loan will include up over the life of a 30-year home mortgage and can have a big effect on your total.

Excitement About What Are The Current Refinance Rates For Mortgages

monetary objectives. Years back, it was more common to avoid window shopping and go right to your main bank as a home loan lender.

The Ultimate Guide To What Do I Need To Know About Mortgages And Rates

When you first start to find out about a reverse mortgage and its associated advantages, your initial impression may be that the loan item is "too excellent to be true." After all, a crucial benefit to this loan, created for property owners age 62 and older, is that it does not require the borrower to make regular monthly home mortgage payments.

Though at first this advantage may make it seem as if there is no repayment of the loan at all, the truth is that a reverse home mortgage is simply another kind of home equity loan and does eventually get paid back. With that in mind, you may ask yourself: without a monthly home loan payment, when and how would repayment of a reverse mortgage take place? A reverse home loan is different from other loan products because payment is not achieved through a monthly home mortgage payment with time. Customers should make the effort to inform themselves about it to be sure they're making the best option about how to utilize their house equity.

Much like a standard mortgage, there are expenses connected with getting a reverse mortgage, particularly the HECM. These expenses are generally greater than those connected with a traditional home loan. Here are a few charges you can anticipate:: The upfront home mortgage insurance premium is paid to the FHA when you close your loan.

If the house costs less than what is due on the loan, this insurance covers the difference so you will not end up undersea on your loan and the loan provider does not lose money on their financial investment. It also safeguards you from losing your loan if your lender fails or can no longer satisfy its obligations for whatever factor.

The expense of the in advance MIP is 2% of the evaluated worth of the home or $726,535 (the FHA's financing limit), whichever is less. For instance, if you own a home that's worth $250,000, your in advance MIP will cost around $5,000 - who took over taylor bean and whitaker mortgages. In addition to an in advance MIP, there is also a yearly MIP that accumulates every year and is paid when the loan comes due.

: The origination cost is the amount of cash a loan provider charges to originate and process your loan. This cost is 2% of very first $200,000 of the home's worth plus 1% of the remaining worth after that. The FHA has set a minimum and maximum cost of the origination fee, so no matter what your home is valued, you will not pay less than $2,500 nor more than $6,000.

Facts About How Many Mortgages Are There In The Us Uncovered

The maintenance cost is a month-to-month charge by the lender to service and administer the loan and can cost as much as $35 monthly. Appraisals are required by HUD and identify the market value of your home. While the true cost of your appraisal will depend on aspects like area and size of the house, they typically cost between $300 and $500.

These expenses may consist of: Credit report costs: $30-$ 50 File preparation fees: $50-$ 100 Courier costs: $50 Escrow, or closing cost: $150-$ 800 Title insurance: depends upon your loan and area There are numerous factors that affect the rates of interest for a reverse mortgage, consisting of the lending institution you deal with, the type of loan you get and whether you get a repaired- or adjustable rate loan.

A reverse mortgage is a way for homeowners ages 62 and older to utilize the equity in their house. With a reverse home mortgage, a house owner who owns their home outright or at least has significant equity to draw from can withdraw a part of their equity without having to repay it up until they leave the home.

Here's how reverse home mortgages work, and what homeowners thinking about one requirement to know. A reverse home mortgage is a type of loan that enables house owners ages 62 and older, usually who have actually settled their home mortgage, to borrow part of their house's equity as tax-free income. Unlike a routine home loan in which the property owner makes payments to the lending institution, with a reverse home loan, the loan provider pays the homeowner.

Supplementing retirement earnings, covering the cost of needed house repair work or paying out-of-pocket medical expenses are common and appropriate usages of reverse mortgage profits, states Bruce McClary, spokesperson for the National Structure for Credit Counseling." In each circumstance where routine earnings or readily available savings are inadequate to cover expenditures, a reverse home loan can keep senior citizens from turning to high-interest credit lines or other more costly loans," McClary states.

To be eligible for a reverse mortgage, the primary house owner needs Take a look at the site here to be age 62 or older. However, if a partner is under 62, you might still be able to get a reverse home loan if you satisfy other eligibility criteria. For example: You must own your home outright or have a single primary lien you want to borrow versus.

What Is The Going Interest Rate On Mortgages Fundamentals Explained

You must reside in the house as your primary residence. You need to remain existing on property taxes, homeowners insurance coverage and other compulsory legal responsibilities, such as homeowners association fees. You must take part in a consumer details session led by a HUD-approved therapist. You must maintain your residential or commercial property and keep it in excellent condition.

There are various kinds of reverse mortgages, and every one fits a different monetary need. The most popular kind of reverse home mortgage, these federally-insured mortgages typically have higher upfront costs, but the funds can be used for any function. Although commonly readily available, HECMs are just offered by Federal Real estate Administration (FHA)- approved loan providers, and before closing, all customers should get HUD-approved counseling.

You can typically receive a larger loan advance from this kind of reverse home loan, specifically if you have a higher-valued house. This home loan is not as common as the other two, and is typically offered by nonprofit companies and state and city government companies. Borrowers can just use the loan (which is generally for a much smaller sized quantity) to cover one particular function, such as a handicap available remodel, says Jackie Boies, a senior director of real estate and bankruptcy services for Cash Management International, a nonprofit debt therapist based in Sugar Land, Texas.

The quantity a house owner can borrow, referred to as the primary limitation, varies based on the age of the youngest customer or eligible non-borrowing partner, current rate check here of interest, the HECM home mortgage limit ($ 765,600 since July 2020) and the home's worth. Homeowners are most likely to get a greater principal limitation the older they are, the more the property is worth and the lower the rates of interest.

With a variable rate, your options include: Equal monthly payments, supplied a minimum of one borrower lives in the residential or commercial property as their primary home Equal month-to-month payments for a set period of months agreed on ahead of time A credit line that can be accessed until it runs out A mix of a credit line and repaired http://messiahqbuh180.theglensecret.com/how-to-rate-shop-for-mortgages-fundamentals-explained month-to-month payments for as long as you reside in the house A combination of a credit line plus fixed month-to-month payments for a set length of time If you choose a HECM with a fixed interest rate, on the other hand, you'll get a single-disbursement, lump-sum payment.

The amount of money you can obtain from a reverse home mortgage relies on a number of elements, according to Boies, such as the current market price of your house, your age, existing interest rates, the type of reverse home mortgage, its associated expenses and your monetary assessment. The quantity you receive will likewise be impacted if the house has any other mortgages or liens.

The 2-Minute Rule for How Many Risky Mortgages Were Sold